How the Proposed Tax Changes Could Affect You – Before the New Year

Why You Should Be Thinking About Taxes NOW

October 2021

Tax planning is a key part of smart retirement planning. Without proper planning, you will very likely pay more taxes overall in retirement (and have less money to spend or give away). I have written on this before: Lower Your Tax Bill and Have More Money in Retirement

In light of the recent proposed tax legislation on September 13, the need for proactive tax planning is more important than ever. As of this writing, the legislation in its present form has not passed. I suspect many parts of the legislation will pass this year; some will be changed. Next year… well, that’s another story altogether.

In any case, buckle up. The proposed tax changes we have seen and will continue to see in the coming months and years will be significant. Even if you think you may not be impacted by this round, you should still pay attention.

Summary and Planning Implications

Below is a summary of the proposed changes with some basic planning implications. Keep in mind, there is no guarantee that these changes will be enacted. The appropriate tax planning strategies you should employ this fall and in 2022 depend on your circumstances. (No surprise there.)

After months of anticipation, the House Ways and Means Committee released the first draft of major tax legislation on September 13, 2021, designed to raise $2.9 trillion over the next 10 years. This is to cover a two-track process of infrastructure and social reforms. It’s called: Subtitle I: “Responsibly Funding Our Priorities.” The proposals are very different than what most people expected!

1. Lower/Middle Income Largely Unaffected

Single filers with income below $400,000 and Married Filing Joint filers with income below $450,000 will probably not see significant impact, at least not right away.

2. Corporate Tax Rate

Raises the corporate tax rate from 21% to 26.5%. Unless you own a corporation, this won’t impact you directly. However, there may be indirect impact via increased prices further down the road.

3. Higher Marginal Tax Rates & Capital Gains

-

- Taxpayers with income over the above thresholds noted in #1 above should expect both higher marginal rates and higher capital gains rates.

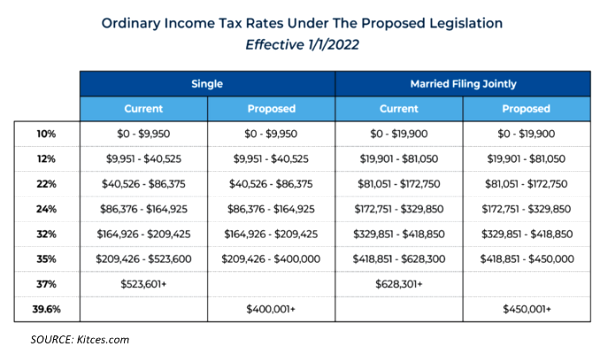

- The proposed bill brings back the 39.6% marginal bracket on ordinary income and (notably) with lowered income thresholds.

Planning: The thresholds for paying a higher tax have been reduced, meaning lower incomes pay the higher tax starting in 2022. If your income is in the range of $400,000 – $500,000 (married or single), it may make sense to realize some of this income this year, if possible. Should you consider a Roth IRA conversion?

-

- For taxable income over the $400K/$450K thresholds, capital gains increase from 20% to 25%. While unpleasant, recall that President Biden’s original proposal included a top capital gains rate of 39.6%.

Planning: With a small exception, the proposal for cap gains increase is to be effective as of September 14, 2021. This limits options if you have a large capital gain to take later in the year.

-

- With the income threshold being so close for Single and MFJ, the marriage penalty has reappeared. This could cost married couples tens of thousands of dollars.

4. Traditional Roth Conversions

Elimination of Roth conversions for folks over the income thresholds noted above in #1… but not until 2031!

5. Backdoor Roth Conversions

The strategy of making non-deductible IRA contributions and then converting them to a Roth IRA – or the “backdoor Roth” – looks like it’s on its way out starting in 2022. The same goes for the “mega backdoor Roth” strategy inside of 401k plans.

Planning: Consider funding your back-door and mega back-door Roth IRA conversions this year before the end of 2021.

6. Gift and Estate Taxes at Death

The gift and estate tax exemption amounts would effectively be cut in half starting in 2022 (to pre-2017 levels). That would still be over $5 million/person, though.

Planning: Use or lose the estate gift tax exemption above $5M by year end. If you have assets valued over $5M, and you are confident that you won’t need them, you may want to consider gifting assets out of the estate before year end.

7. The 3.8% Net Investment Income Tax (NIIT)

The application of the NIIT to S-Corp distributions for taxpayers with income higher than $400,000 (individual) or $500,000 (married filing jointly).

8. QBI Deductions

Limitations of the QBI Deduction (199A deduction) for high income taxpayers

9. Tax Credits – Children

Increases to both the Child Tax Credit and the Child and Dependent Care Credits. These credits are fully refundable, with income phaseouts at $150,000 for married couples, $112,500 for Head of Household, and $75,000 for individual filers.

Planning: If your income (MFJ) is close to the $150,000 phase out limit, consider reducing income beginning in 2022, so if your close, try to keep your income below this limit .

Key Takeaway

Tax planning should be a part of your annual financial planning process. This mantra is true even without sweeping tax law changes.

In summary, you should be doing tax planning, and it’s now more important than ever. If your advisor isn’t talking to you about tax planning, you may want to consider changing advisors.

In the end, the very best strategy is to be pro-active in your tax planning, not reactive as you pick up each years completed returns from your tax preparer! An experienced and trusted advisor will work with your tax preparer and help you develop the comprehensive tax strategies that will pay off for years to come.

Have questions? Want to learn more? Email Lorie at lscheibel@scheibelplanning.com or GO HERE to schedule a no-cost, no-obligation call.

*Note: Neither Scheibel Planning Solutions nor Cambridge provides tax or legal advice.