When Two Worlds Collide

Last week, Vladimir Putin launched an invasion of his neighbor Ukraine, despite repeatedly denying allegations he had designs to do so. It was a dramatic and sad day. With an increased anxiety level, I boarded a plane the next morning and traveled to sunny Florida for a preplanned, long weekend getaway. The airport was packed, chaotic even, with many people doing the same. War appeared to be the furthest thing from the travelers’ minds.

I have been calling you, my clients and friends, over the past few weeks as market volatility soared and our portfolios ricocheted up and down. But writing this has been more difficult for me. My emotions and compassion for the people whose lives are being impacted (and lost) feels at odds with the anxiety many feel around what is happening in the markets. I am not entirely sure how to go from one to the other, or even if we SHOULD go from one to the other.

But, my job as a financial planner is to ensure that your financial house is in good order and that you have a high degree of confidence that this is so, no matter what happens in your life or the markets. What this really means is that I manage people and their emotions.

Investment Reminders

It’s worth reminding ourselves of the rules of the retirement investment road:

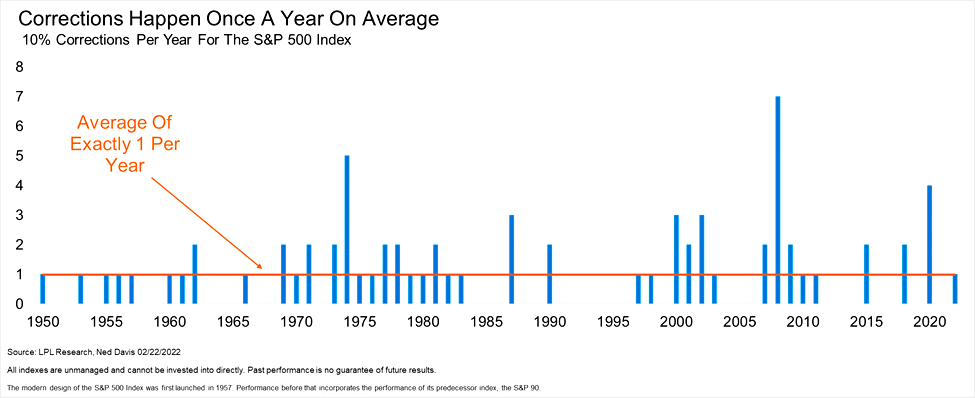

- A market correction occurs when prices fall 10. The S&P 500 has had a correction roughly once a year.

- It doesn’t feel good, but corrections are a normal part of the process.

- Stocks never go up in a straight line. But the trend over time is always up.

- There is no upside without downside. You have to pay to play.

- We earn our permanent long-term return by riding out the temporary downs.

- We must be long-term patient investors and never react to current events.

- The investing timeline is long term even in retirement.

- If you are in or near retirement, you must have some safe money for short-term needs that isn’t subject to sharp term market fluctuations.

To be successful, our portfolios need to grow even in retirement. To keep our financial houses in order, we must have a plan that considers market movements. To have lifetime success, we must stick to the plan and not react emotionally to market movements.

Scary things come and go. Most often, the best thing we can do when things get scary is nothing. My job is to help you do nothing when doing nothing is the right thing to do.*

After a Correction

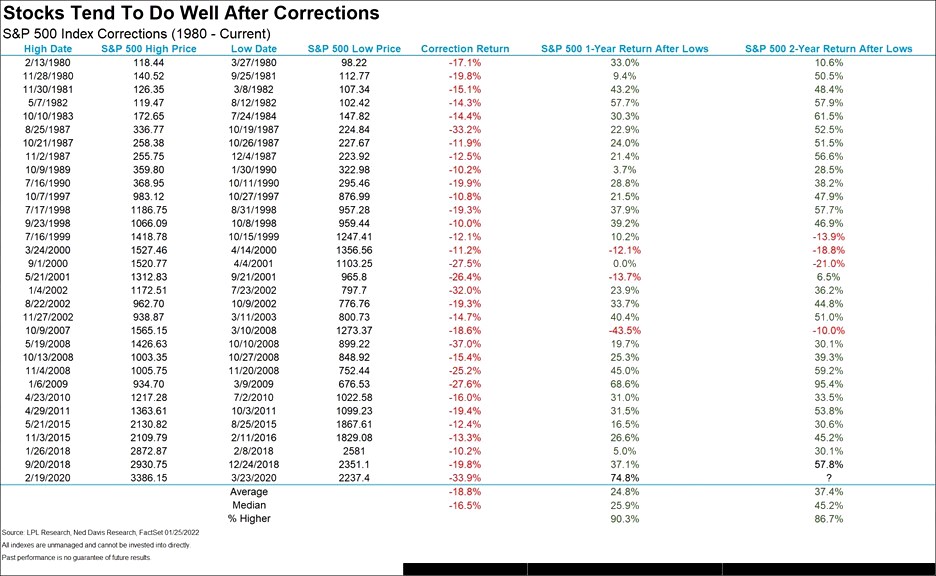

Here’s a list of all the other corrections since 1980. Each felt really bad as well. A year later? Up 25% on avg and higher 90% of the time. Two years out gets ever better.

This correction could move into a bear market or go the way of most other corrections (it’s possible). But the correction could set the stage for a rebound (it’s more likely).

I know you are thinking: this is different. All geopolitical events are different. But they are not different. World War II, Vietnam, Iraq. They are not different. The stock market doesn’t’ react badly to war.

*I work with clients to align their financial decisions to their values and goals and help them get and keep their financial house in order. If you are unsure about what actions you should take, if any, please get in touch with me.

Have questions? Want to learn more? Email Lorie at lscheibel@scheibelplanning.com or GO HERE to schedule a no-cost, no-obligation call.

*Note: Neither Scheibel Planning Solutions nor Cambridge provides tax or legal advice.