Smart Retirement Solutions for Smart Women and Couples

Get your questions answered and make informed decisions over time with an integrative planning process and a long term partner.

Smart Retirement Solutions For Smart Women

Get your questions answered and make informed decisions over time with an integrative planning process and a long term partner.

Uncertainty is Stressful

Okay, you can't control everything.

But you can get answers to all those concerns keeping you up at night...so you don't have to worry.

Smart REtirement Planning

Starts With A Process

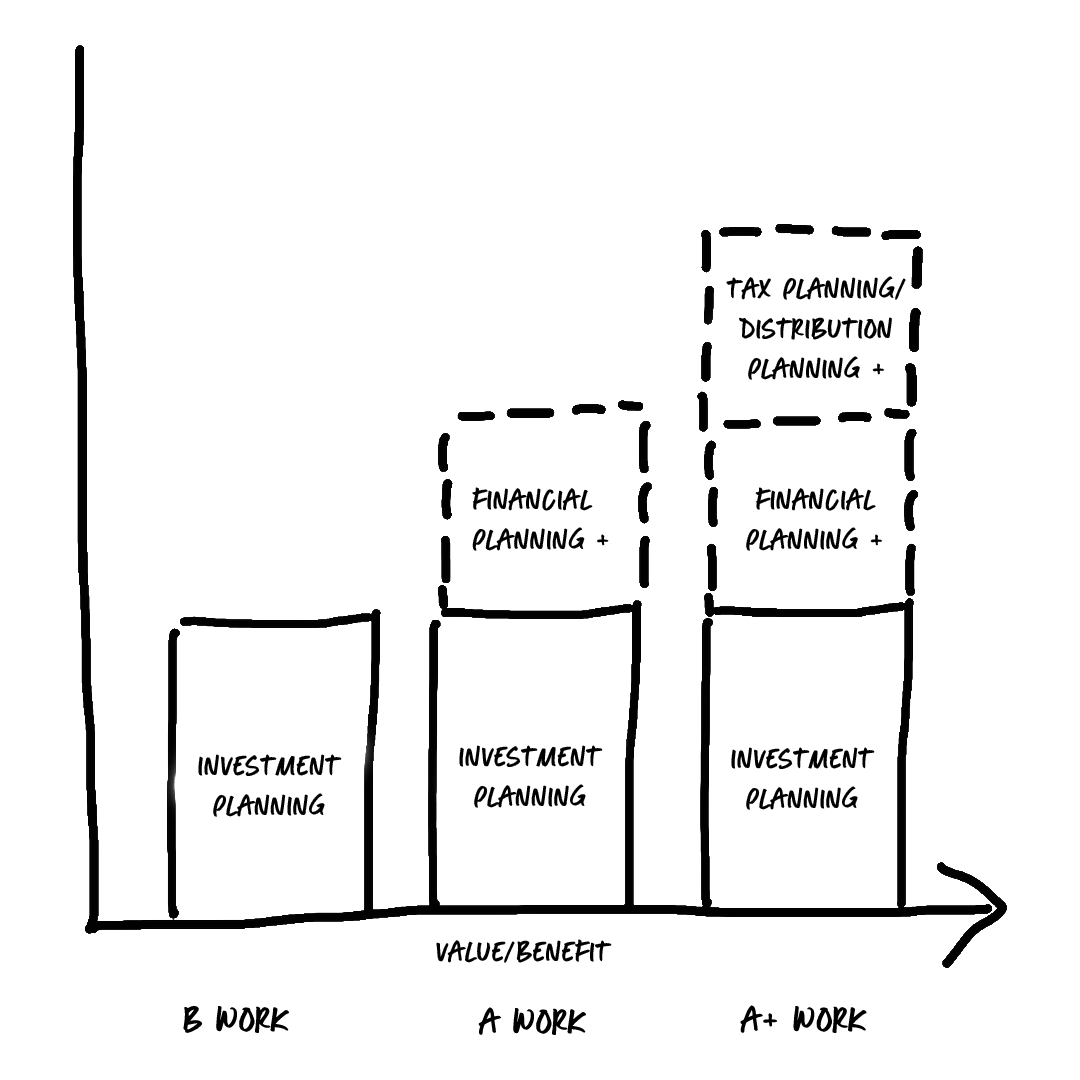

Good investments management is just the start of financial well-being.

Add comprehensive financial planning and you're halfway there.

But the real magic happens when you add Tax and Distribution planning into the process.

Integrative planning in all three areas is my secret weapon. It's the RetireSmart® Planning Process

Everything You Need To

Make Informed Retirement Planning Decisions

Get a clear plan and a partner to guide you through every stage.

1: Get Your Questions Answered.

All good planning starts with awareness.

My integrative process helps us clarify where you are and where you want to go:

- Get clear on your current financial situation

- Demystify your options for improvement

- Make informed decisions moving forward

2: Identify your potential in all areas

Financial well-being means something different to everyone.

I'm here to listen deeply and understand what it means to you. Then design a custom plan to help you achieve it.

- Money Goals Consultation

- Quantitative analysis of your numbers

- Personalized retirement planning

3: Track Your Progress

Financial planning is a process, not a one-time event.

With my clients-only SmartRetirementTracker® online software we analyze your numbers and make adjustments over time.

- Access your SmartRetirementTracker® software

- Stress-test your numbers

- Optimize your retirement plan

4: Make Smarter Decisions

Life rarely goes as planned. There's a difference between having a plan and planning.

We'll continue to analyze and adapt your Retirement Plan as your financial and personal goals evolve.

- Ongoing retirement planning

- Adjustments for economic & life changes

- Up to date financial advice & education

5: Retire Into Freedom

Most retirement plans include investment management and financial planning.

But did you know you can get even more out of your retirement plan when you cover Tax & Distribution Planning? This 3-tiered integrative process is my secret weapon.

- Investment Planning

- Financial Planning

- Smart Tax & Distribution Planning

Make Informed Decisions

In All Areas

There's no one-size-fits-all strategy for retirement planning.

Together, we'll design the right one for you.

Business Owner Planning

Business Owner Planning

- What’s my business worth ?

- Am I protected in case of unforeseen events?

- How do I retain employees for growth?

- How do I best exit and ensure enough money to fund my goals?

Retirement Income Planning

Retirement Income Planning

- How do I create a “paycheck” in retirement?

- What are my pension distribution options?

- Should I consider an annuity?

Investment Planning

Investment Planning

- Is my investment portfolio suited to my goals with appropriate risk?

- Can it be improved?

- Can it be sustained through good and bad times?

Social Security and Medicare Planning

Social Security and Medicare Planning

- When should I take retirement for the maximum benefit?

- Should I consider waiting and what is the advantage?

- How do I integrate Social Security with my other income streams?

- How do I plan for medical care costs in retirement?

Insurance Planning

Insurance Planning

- How much life insurance if any is right for me?

- Should I purchase Long Term Care Insurance?

- What types of insurance meet my needs?

- Am I overpaying for insurance?

Tax Planning

Tax Planning

- Am I paying too much now and in the future?

- How can I reduce the taxes I pay?

Real Estate Planning

Real Estate Planning

- Should I invest in or liquidate real estate investments?

- How much can I spend on my next home?

- Should I pay cash or finance a property purchase?

Lifestyle/Cash-Flow Planning

Lifestyle/Cash-Flow Planning

- How much money can I spend and still accomplish my long-term goals?

- How do I separate the wants versus the needs?

Estate and Charitable Planning

Estate and Charitable Planning

- Is my wealth protected in the way I want?

- Is my plan in place and organized for my business and my family?

- How can I ensure my wealth is distributed to family and charity with the least possible tax consequence?

Get a Clear Path

To Financial Well-Being

Creating Your Plan

It's hard to make informed decisions without information.

My integrative retirement planning process helps you understand your current financial picture and create a plan that's aligned to what's important to you and designed to evolve with you.

We'll create your plan over a series of 1:1 strategy sessions and using my clients-only SmartRetirementTracker® online software to track and analyze your numbers in real-time.

To kick off the planning process, I offer a complimentary getting-to-know-you meeting.

If we're a good fit, we'll schedule our first strategy session.

Putting Your Plan In Action

Retirement planning is an ongoing process, not a single event.

Your planning should evolve to meet your changing needs and goals.

My integrative process is designed to achieve just that. Once we put your retirement plan in action, we'll meet 2-3 more times annually to review your situation and make adjustments as needed.

You'll also receive regular email updates and action steps as I track your progress using my SmartRetirementTracker® software.

Together, we'll evaluate future opportunities as we make informed planning decisions today.

Read My

Case Studies

Sandra felt totally stuck when it came to retirement planning. Together we got clear on her current financial picture and created a plan that aligned with her personal and financial goals. Instead of worrying over money, she's now got a proven process to take control of her finances for years to come.

The case studies presented here are hypothetical and only represent a scenario that might occur. They do not represent a specific client or situation. Any resemblance to an actual client or event is coincidental.

Take The

First Step Today!

Choosing who to entrust with your financial future is a critical decision and you need to feel comfortable.

I don't take it lightly.

That's why I offer a complimentary getting-to-know-you call.

If it feels like we're a good fit, we'll schedule one more complimentary session.

We'll have a deeper discussion of your goals, concerns and vision, and get clear on the planning process.