Do I Have Enough Money?

To Change My Work, My Priorities, My Lifestyle? To Retire?

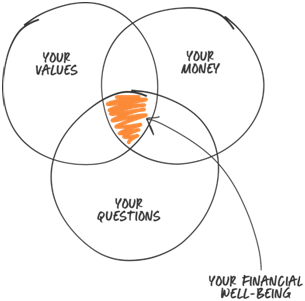

The Real Answer: Both Art and Science

Do you spend time wondering if you have enough resources to stop working now (or change how you work) and begin the pivot to a different kind of life, one where working and saving is not your priority? Does that sound wonderful to you? If so, read on.

The Numbers:

At its essence, the question is simple: how much money do I need to retire? What’s “my number”, my “nut”? It’s also a very common question, asked by many at almost every income level. You can do a quick google search and come up with many online calculators to get to “the number”. Each one is different and will give a different “number”. All are based on a set of assumptions about the future, that include some version of your assets, your spending and the cost of living.**

There are also a number of simple rules-of-thumb you can use to get an approximate number. Here is an example: multiply your annual spending needs by 25. For example, say you want to supplement your other income (e.g., social security, pension) with an annual distribution of $50,000. According to this formula, you will need about $1,250,000 when you retire*. ($50,000 x 25 = $1,250,000). This is actually the flip side of the 4% rule. The results can form a useful (if very basic) framework of understanding your retirement readiness and the variables to consider.

*Note: in the simple example, I did not factor in taxes to be paid. The $50,000 annual income need is (presumably) an after-tax amount, thus the $1,250,000 is also an after-tax amount. If you want to learn more about the impact of taxes on your retirement, go https://scheibelplanningsolutions.com/lower-your-tax-bill-and-have-more-money-in-retirement/

Assuming you have $1,000,000, then you need to only save another $250,000 and then retire. Right? Not so fast.

The Art: Beyond the Numbers

Yes, you should know if you have enough money to pay for food and shelter and health care for the next 30+ years. Understand this part first; it’s vitally important. But this information is empty without a sense of what you want to do and who you want to live in your next phase of life.

What are your priorities?

What do you want your life to be like in the next 10 years? The next 20 to 30 years?

These questions must be asked. They are the ART of the art and science of good financial planning.

To do really good financial planning, you have to have not one, but two questions to consider. The first is infinitely easier to answer than the second. Both answers matter.

- Do I have enough?

- How do I want to live?

A Thought Experiment

Just for a moment, imagine that you had all the money in the world and didn’t need to wonder or worry at all if you have enough to retire. You could do whatever you wanted. What would you do differently?

Imagine the possibilities…

If you had all the money in the world, your thoughts would be focused instead on how to live most abundantly.

Now apply this thinking to your (constrained) situation. Ask better questions. Envisioning an abundant life is a different process and involves a different set of questions for each of us. For most, it’s sticky and not easy to think like this.

Your questions might relate to:

- Your activities and spare time: how will you use them in a way that is enjoyable and rewarding?

- Your friends and social relationships: do you have meaningful social relationships nearby? If not, how will you develop them?

- Your family: how will you be involved regularly if this is important to you?

- Your community: how can you use your interests and talents to contribute to the world at large, growing you and helping others?

- Your life: what can you do to make sure that your life has true meaning and purpose?

With a deeper connection to your priorities and values, your analysis and planning are fundamentally different. Planning becomes an iterative process of reflecting on and evaluating where you have been and where you are going and then revising your priorities, values, and goals. Then, your planning is adjusted accordingly.

True Financial Planning

True financial planning integrates both the quantitative and the qualitative. The process, which can be sticky at times, figures the quantitative possibilities, “the science”, and then layers upon this your values, your goals, your dreams. It is an iterative process as your life and priorities change.

The numbers alone are meaningless, unless they are aligned to your values, hopes and dreams.

Using this iterative process, our firm works with women and couples near to retirement to align their values with their money and make smart financial decisions.

Please reach out for a conversation or question or if you want a partner who can guide you through this process, and make smart financial decisions while doing so.

**Disclosure: All examples are hypothetical and for illustrative purposes only. The rates of return do not represent any actual investment and cannot be guaranteed. Any investment involves potential loss of principal.